What Is The Maximum Income To File Taxes In 2025. You probably have to file a tax return in 2025 if your 2025 gross income was at least $13,850 as a single filer or $27,700 if married filing jointly. You file a joint return, and you and your spouse have a combined.

Here are the answers to some of the most frequently asked questions about filing taxes. Page last reviewed or updated:

The maximum earned income tax credit in 2025 for single and joint filers is $632 if the filer has no children (table 5).

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Publication 501 (2025), dependents, standard deduction, and filing information. The maximum credit is $4,213 for one child,.

Payroll Taxes Filing Deadlines, Rates, and Employer Responsibilities, That equals a tax bill of $17,053 for 2025, compared to $17,390 for 2025. Find the appropriate boxes listing the income thresholds for your taxable income and filing status to determine how much of your income you’ll pay in each.

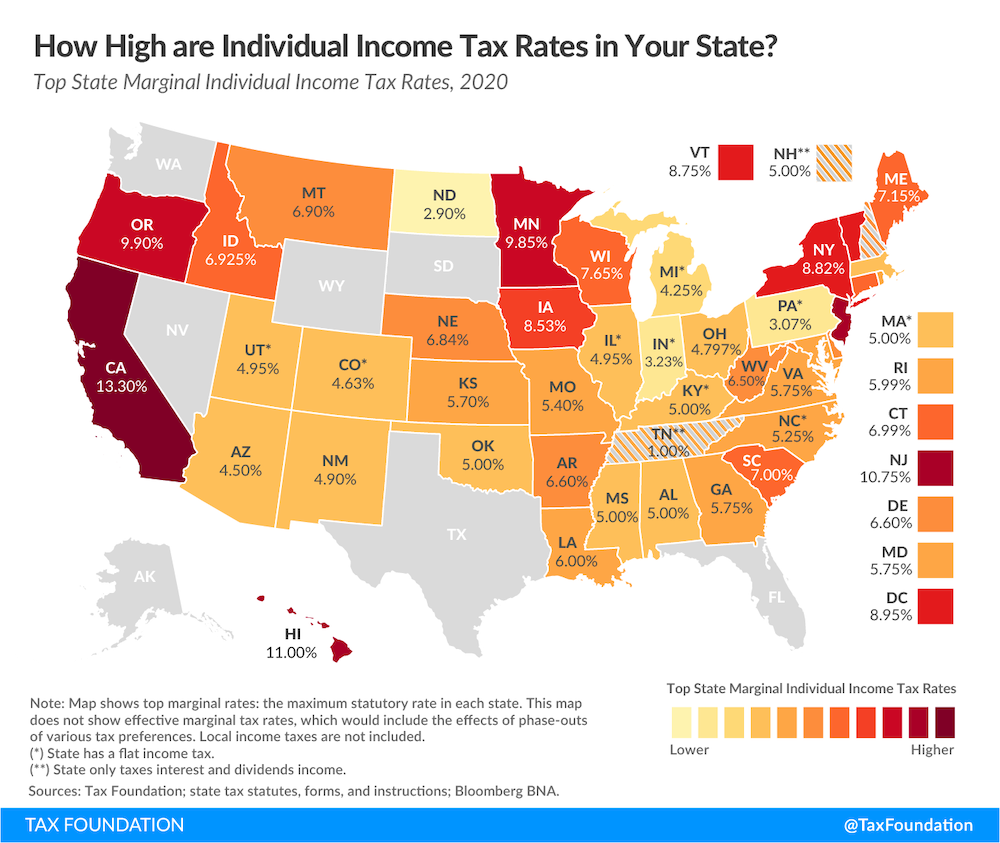

States With High Taxes Face Grim Future in Tax Policy Revolution, Publication 501 (2025), dependents, standard deduction, and filing information. The end of the 2025 tax season for most americans is april 15, 2025.

2025 Tax Filing Threshold Printable Forms Free Online, $13,850 if younger than 65. Taxable income how to file your taxes:

2025 Tax Brackets The Best To Live A Great Life, How much do i have to make to file taxes in 2025? The maximum credit is $4,213 for one child,.

Here's where your federal tax dollars go NBC News, Here are the answers to some of the most frequently asked questions about filing taxes. Depending on your age, filing status, and dependents, for the 2025 tax year, the gross income threshold for filing taxes is between $12,950 and $28,700.

![United States tax by state [1000 x 755] MapPorn](https://external-preview.redd.it/WVNNG0GL9OXX2ZCwMb-W4IvT2hCSMKl3U0fjdWNragM.jpg?width=960&crop=smart&auto=webp&s=c4a25dc5c35df5454002ab6a471d70b3df72677a)

United States tax by state [1000 x 755] MapPorn, You can file for an. $27,700 if both spouses are younger than 65.

Minnesota ranks 8th nationally for its reliance on taxes, Step by step irs provides tax inflation adjustments for tax year 2025 full. Page last reviewed or updated:

Personal Tax Brackets 2025 Casey Cynthea, $13,850 if younger than 65. For 2025, the maximum earned income tax credit (eitc) amount available is $7,830 for married taxpayers filing jointly who have three or more qualifying.

Limit For Maximum Social Security Tax 2025 Financial Samurai, Gifting can help reduce the value of your estate without using up your lifetime gift and estate tax exemption. Depending on your age, filing status, and dependents, for the 2025 tax year, the gross income threshold for filing taxes is between $12,950 and $28,700.